У червневому звіті про макроекономічну стабільність Національного банку України вказано, що після послаблення обмежень на обмін валюти і подальше розміщення на депозити, попит на послугу обміну гривні на іноземну валюту значно зменшився.

На фоні цього спостерігається зменшення обсягів строкових депозитів населення в іноземній валюті, що підтверджується даними НБУ.

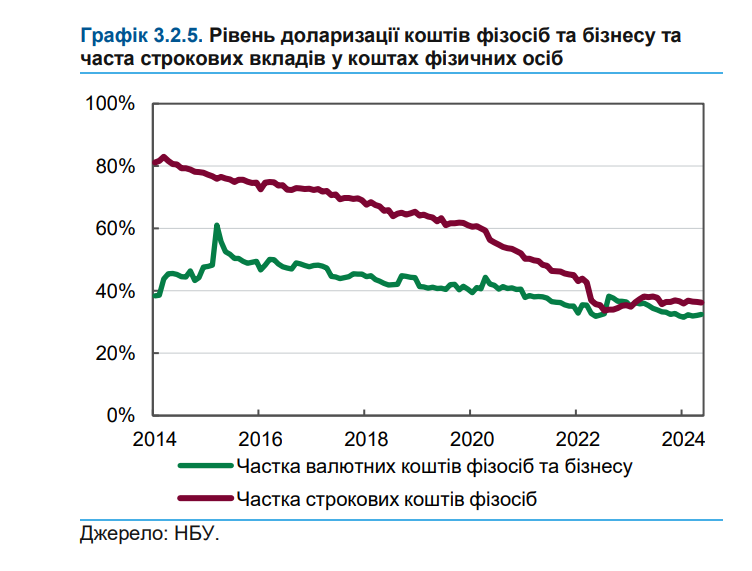

За період з початку поточного року частка валютних коштів у клієнтських вкладах становить приблизно 32%, що є низьким історичним показником. Банки продовжують утримуватися від активного залучення валютних вкладів через обмежені можливості їхнього ефективного інвестування.

У зв’язку з високими ставками за активами в іноземній валюті, банки забезпечують додатковий дохід, розміщуючи кошти в низькоризикових інструментах, таких як депозити в іноземних банках та облігаціях інвестиційного класу. Однак прогнозується, що очікуване зниження ключових ставок у розвинених країнах знизить ці можливості в майбутньому.

Тому, за даними Національного банку України, банки і надалі не матимуть стимулів активно пропагувати здійснення валютних вкладень серед клієнтів.