Since the beginning of 2024, Ukrainians began to actively build up debts for microloans, also known as "payday loans". The total amount of debt increased by 1.7 times, reaching 16.02 billion hryvnias. Every month, Ukrainians take out about 670,000 such loans.

The average loan amount increased by 28% compared to last year, reaching UAH 6,190. This indicates a growing demand for microloans, although high interest rates remain the main problem for borrowers.

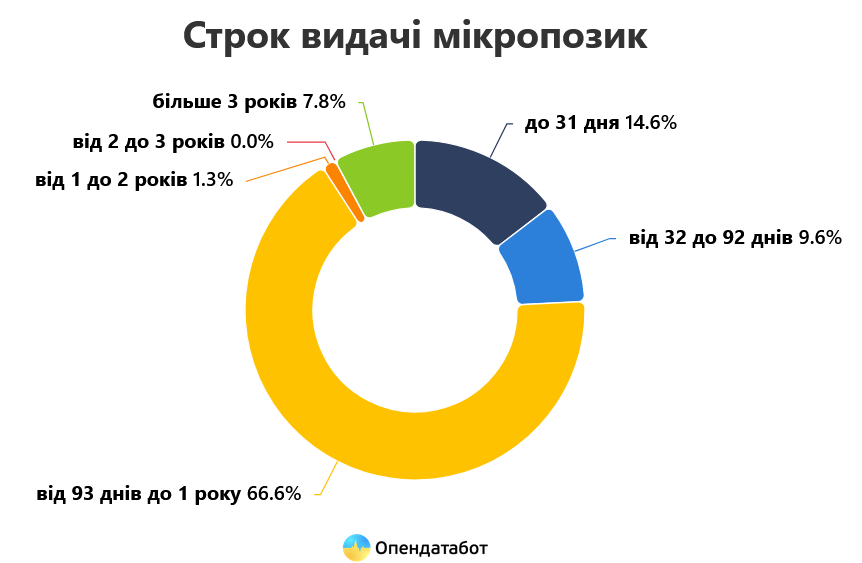

Most often, Ukrainians take out loans for a period of 93 days to 1 year, which is 66.6% of all loans. But there are also those who take money for up to 31 days (14.6%) or for a longer period (32-92 days - 9.6%).

Companies actively offer promotional conditions for new customers, trying to attract them to use microloans. For example, one of the enterprises promises a loan of 15 thousand hryvnias to take only 45 hryvnias per month. But the real terms of the loan often include incredibly high annual interest rates, which can reach 105,015% per year.

The main risk is that if the loan is not repaid on time, the customer may end up in a debt hole due to extremely high interest rates. As rates increase exponentially with outstanding debt, borrowers face huge financial challenges.